Solar Services

Generators

Battery Storage

EV Chargers

Solar Savings

The 30% Solar Tax Credit Could Disappear Sooner Than You Think

The federal 30% Residential Clean Energy Credit—commonly known as the solar tax credit—is still available in 2025, offering significant savings by allowing homeowners to deduct 30% of their solar installation costs from their federal taxes. However, recent discussions in Washington have raised concerns about potential changes to the program as early as fall of 2025. These could include an early phase-out, reduced credit amounts, or added eligibility requirements tied to manufacturing or sourcing.

Although the credit is currently set to decrease to 26% in 2033 and expiring in 2035, the future of these incentives is uncertain.

Now is the ideal time to invest in solar and lock in your full 30% tax credit before any changes take effect. Start saving now and permanently protect your investment from utility rate inflation. Contact ECG Solar for a no hassle, no obligation quote today to see if solar is right for you.

Incentives For

Solar Power

Below are several resources that will help you discover the incentives, grants, and rebates available to offset the cost of installing a solar PV system for your home or business, as well as other types of renewable systems. We suggest you start with consulting with ECG Solar™; our extensive experience and knowledge of these programs can help identify applicable incentive programs for you.

Note: We do not offer CPA or investment advice and consulting, so we suggest you confer with your own professional to confirm how these incentives will impact your project and financial portfolio.

IRA Incentive Package Summary

What Is A

Solar Tax Credit?

A tax credit is an amount of money that taxpayers can subtract directly from the taxes they owe. Unlike deductions, which lower the amount of taxable income, tax credits reduce the actual amount of tax owed. A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000.

Disclaimer: ECG Solar provides an overview of the federal investment tax credit for solar photovoltaics (PV) and battery systems. It does not constitute professional tax advice or other professional financial guidance. And it should not be used as the only source of information when making purchasing decisions, investment decisions, tax decisions, or when executing other binding agreements.

In order to claim a federal tax credit, the solar energy system must be in service during the tax year and generate electricity for a home within the United States. There are many stipulations that should be gone through and examined, the links to which can be found below.

Types Of

Tax Credits

Residential Solar PV

ITC for 3rd Party Owned Residential Systems

Third-party-owned (TPO) residential systems are financed and receive the ITC via the business tax code. For details on the business ITC, see the next section. As before, a system is directly owned by an individual taxpayer and claims the personal tax credit or is TPO and has the tax credit claimed by the third-party owner, not both.

Commercial Solar PV

ITC Transferability

Taxable entities may transfer any applicable credit to another taxpayer. Transfer may be all or a portion of the credit within 3 years and transferred only once. See section 13801 of the tax bill for more details.

Section 25C Investment Tax Credit for Clean Energy Property

Extended at 30% through 2032; beginning with property placed in service after 2022, lifetime cap replaced with an annual cap of $1,200 except for heat pumps, heat pump water heaters, biomass stoves and biomass boilers which are capped at $2,000 in aggregate. Credit also applies to improvement to or replacement of a panelboard, sub-panelboard, branch circuits or feeders that have capacity of at least 200 amps and are installed to enable the “installation or use” other eligible property under this Section 25C.

Electric Vehicles

Residential EV Chargers

30% Investment Tax Credit (ITC) up to $1,000.00, no refunds and does not qualify or IRA direct pay program. Carries over for 7 years if cannot be used all at once. Drops to 26% in 2033, 22% in 2034 and 0% in 2035.

Commercial EV Chargers

30% Investment Tax Credit (ITC) up to $100,000.00 per charger, no refunds and does not qualify or IRA direct pay program. Carries over for 7 years if cannot be used all at once. Drops to 26% in 2033, 22% in 2034 and 0% in 2035.

Home Owner Rebates

Residential Efficiency and Electrification Rebates

The IRA provides $4.3 billion to State Energy Offices to establish rebates for a variety of home energy upgrades under the Home Owner Managing Energy Savings (HOMES) rebate program. Rebates for home energy retrofits up to the lesser $8,000 per home or 80% of project cost if the project saves at least 35%. Lesser amounts available if projects save less than 35%. Multi-family rebates are also supported with different rebate amounts. Caps can increase for low- and moderate-income families with approval of the Secretary. Cannot be combined with High-Efficiency Electric Home Rebate Program.

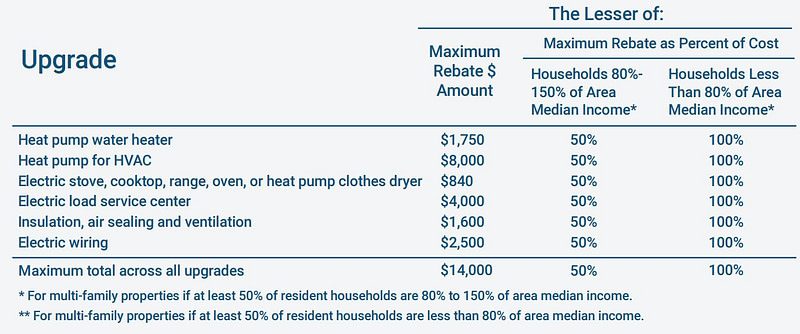

High-Efficiency Electric Home Rebate Program

Other Rebates

Energy Storage Systems (Battery)

30% Investment Tax Credit (ITC) for 3 kWh capacity or larger and can charge from any source, no cap on project cost, no refunds and does not qualify or IRA direct pay program. Carries over for 7 years if cannot be used all at once. Drops to 26% in 2033, 22% in 2034 and 0% in 2035.

Utility-Scale, Commercial, Industrial, Non-Profit, Government, Etc. and Third-Party-Owned Residential

The business investment tax credit is extended and lifted to 30% for projects that have started or start construction before the end of 2024 and the credit becomes available to stand-alone storage. Solar also becomes eligible for the production tax credit which is currently at $0.026/kWh for 2022 and rises with inflation. After 2024, the credit transitions to a “tech neutral” structure.

Inflation Reduction Act ITC and PTC

Under the IRA, projects will be able to choose the ITC or PTC. Both credits come with potential adders for meeting certain domestic content requirements, locating in energy communities, or allocated credits for being on qualified low-income property. The level of the base credits and adders are shown in the tables below. Stand-alone storage is eligible only for the ITC. Both ITC and PTC credits become transferable. The ITC becomes available for costs of interconnection for projects with a net output of less than 5 MWac. Direct pay becomes available for state and tribal governments, Alaska native corporations, certain tax-exempt entities and rural cooperatives. All timelines below are subject to specific placed-in-service and start-construction deadlines and documentation requirements.

Direct Pay

Program

Now, tax-exempt organizations like public schools, cities and nonprofits can get those credits by direct pay, and receive a check for 30% of the project cost just like a tax-paying entity would receive the credit when filing taxes. Direct pay paves the way for organizations to own solar projects instead of just buying the power through PPAs. Although the industry is awaiting official guidance from the Treasury Department regarding the logistics of direct pay and other IRA provisions, the basic qualifying factors are spelled out in the statute. Here are the entities that can access direct pay for the solar ITC.

-

1. Tax-exempt Organizations (401c)

Any organization that has filed an application with the federal government for tax-exempt status will qualify for direct pay. This could include state colleges and universities, nonprofit organizations and more. It excludes homeowners’ associations (HOAs). -

2. State, Local and Tribal governments

Any governmental entities can receive direct pay for the solar ITC. This includes public schools, colleges, universities, city, county, state owned buildings. -

3. Rural Electric Cooperatives

Rural electric Co-ops now qualify for direct pay, allowing them to own their solar projects and receive credits directly. -

4. The TVA

The Tennessee Valley Authority is a federally owned electric utility corporation that can now receive direct pay for solar projects.

Other Incentives

State Incentives

Currently Iowa no longer offers a state level tax credit, rebate or cash incentive on any Solar, Battery, EV’s, EV Chargers or energy improvements. Iowa excepts sales tax on all renewable energy projects Iowa Code 423.3 as well as Property Tax Exemption for Renewable Energy Systems per Iowa Code 441.21(8). Additional laws are also in place such as Net-Metering under Iowa Code 199.15.11(5) and Iowa Solar Easement and Access Laws under Iowa Code 564A.

Utility Incentives

Currently we are not aware of any cash incentives or rebates offered by any one of the publicly traded companies such as Mid-American Energy or Allaint Energy for renewable energy projects. Please contact your electrical provider by phone or web site to discover any new programs they may offer. You can also use the DSIRE web site to search for other such programs. (https://www.dsireusa.org/)

Manufacturing

The IRA establishes two credits for manufacturers; 1. A 30% investment tax credit (Section 48C) for eligible investment costs in facilities and equipment and 2. A manufacturing production credit for certain components based on the volume of product manufactured. Manufacturers can only seek to take one or the other; that is, a manufacturer cannot claim the investment credit and then claim the production credit for product from the same factory. Ten billion dollars are allocated for the Section 48C tax credits, and up to six billion dollars can go to projects located outside of census tracts (or adjacent tracts) where a coal mine closed after 1999 or a coal-fired power plant was retired after 2009. To receive the full 30% credit, a project must meet prevailing wage and apprenticeship requirements Otherwise, the credit will be six percent. There is also no direct pay option, with limited exceptions, and manufacturers must apply and be chosen for the Section 48C tax credit. Credits are based on application and award process.

Additional Provisions from the IRA

The IRA contains many other provisions important to the energy transition of direct or indirect interest to the solar energy and energy storage industries, including the provisions listed here

- $500 million for the Defense Production Act (some of which could be used for solar manufacturing)

- Greenhouse Gas Reduction Fund totaling $29 billion overseen by the Environmental Protection Agency

- Climate Pollution Reduction Grants to state and local governments totaling $5 billion

- Environmental and Climate Justice Block Grants: $3 billion for disadvantaged communities

- Department of Energy Loan Program Office gets an additional $40 billion in commitment authority

- $2 billion in loan authority for new transmission construction in designated national interest corridors.

- $760 million for the Department of Energy to issue grants to state, local or tribal entities to facilitate siting of high-voltage interstate transmission

- Solar Right-of-Way Restrictions on Department of Interior lands (right-of-way can only issue if an oil and gas lease sale has been held in previous 120 days, and certain acreage thresholds have been offered in previous year)

- Additional $1 billion for rural renewable energy electrification loans and expansion of the program to include storage Additional $1B for REAP, with total grants limited to 50% of the total cost of an eligible project

- $9.6B for loans and financing for rural co-ops to purchase renewable energy, generation, zero-emission systems, and related transmission, limited to 25% of total cost

- Incentives for build-out of electric vehicle charging networks

- Extension, expansion, and changes to electic vehicle tax credits, including new credit for purchasing EV’s.

ECG Solar™ has been Iowa’s Premier Solar Provider™ of energy storage & production systems since its founding in 2008. For over a decade, we have been a leading supplier of solar panels and energy-efficient systems available. We carry some of the finest products, from Panasonic™ solar panels, Kohler™ standby generators, and Enphase™ battery systems. With ECG Solar™, you can rest assured that you’re receiving top-notch solar conversion services that will help you save money on your electric bill.